Euphoria is a persistent state not justified by objective conditions, characterized by optimism, vigor, and a sense of unlimited possibilities. This is how we can characterize the dynamics of global stock indices, which rose by 15-25% from November 2023 to mid-February 2024.

The equity market has demonstrated excess returns four times over the past five years: in 2019 (+29%), 2020 (+16%), 2021 (+27%), and 2023 (+24%). The last time such consistency of optimism was recorded was in 1994-1999, before the dot-com crisis.

What is the reason for this optimism, and is there a solid basis for further growth?

Arguments for further growth

Artificial intelligence revolution

ChatGPT started gaining popularity in December 2022, after the first results of the free resource were published. This caused a strong hype around AI, giving investors and analysts confidence in the need to apply and develop AI.

A vivid example of the effect of popularizing the AI topic is reflected in the dynamics of Nvidia processor shares – a fivefold increase in 13 months. Or in the policy of Microsoft, which invested $10 billion in the development of ChatGPT and almost $5 billion in the infrastructure around AI last year.

Any revolutionary technology necessitates re-equipment of technical support, improvement of labor efficiency, and substantial investments. Although the trend towards automation and the use of artificial intelligence is not new, the boom in investments in AI technologies is happening right now.

According to Goldman Sachs, AI adoption could boost global GDP by 7% over the next 10 years. This macro-level reassessment supports the growth of the world’s largest corporations.

Liquidity in the global financial system remains high

Central banks printed about $25 trillion of new money in 2020-2021 as a response to the economic threats of COVID-19. As of today, about $8 trillion has been withdrawn from the system, so both banks and corporations still have sufficient resources for development and investment.

Moreover, Japan and China are now considering various options for stimulating the economy, including monetary methods.

At the same time, corporations continue to actively buy back their own shares from the public market. The quarterly volume of buybacks reaches $200 billion, according to VerityData.

Economies of scale or the sustainability of the “magic seven”

In the modern digital era, global leaders continue to strengthen their market share, show record financial performance and have the greatest influence in the capital markets.

The cohort of the so-called “magic seven” includes: Microsoft (market capitalization $3 trillion), Apple ($2.8 trillion), Nvidia ($1.8 trillion), Alphabet ($1.7 trillion), Amazon ($1.7 trillion), META ($1.2 trillion), Tesla ($0.6 trillion). Today, these companies account for 30% of the value and 20% of the revenue of all components of the S&P 500 index.

On a global scale, Google’s search engine accounts for 83% of the market, Bing (Microsoft) – 9%; in the smartphone market, iPhone accounts for 25%. Tesla holds 56% of the electric car market in the US and 17% globally. Nvidia has a dominant 82% share of the GPU market and nearly 70% of sales of all new generation processors.

Facebook accounts for 66% of social media visits in the world, Amazon has 38% of the US ecommerce market, and the AWS cloud platform with a 32% share competes with Microsoft Azure (22%) and Google (11%). This is the data as of January 2024.

The dominant role of these seven corporations allows them to generate super-profits, influence pricing, absorb smaller competitors, and continue to expand. And this adds to the optimism of investors in the stock market.

There are a number of factors that may indicate the formation of a multi-year peak in the stock market.

Negative aspects

Economies of developed countries are slowing down or falling into recession

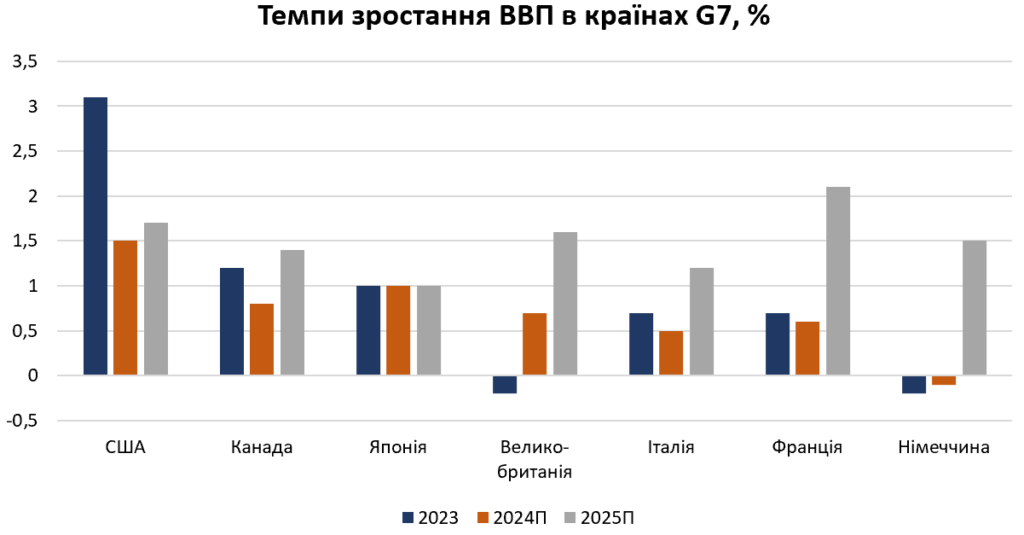

At the end of 2023, GDP decline was recorded in Sweden (-0.3%), Germany (-0.2%), the UK (-0.2%), and Japan (1%, but with negative GDP in Q3-4). “France, Italy, and the Netherlands are balancing on the foul line. The global economy will continue to grow above 3% in 2024, but developed countries will show only 1.5% growth, according to the IMF forecast.

This slowdown in the major money markets threatens to slow down their growth for the world’s leading corporations. As a result, investors’ appetite for their securities will decrease.

The locomotive of the last decade, China, is steadily slowing down from the economic boom of 6-9% by 2020 to 3-5% in the next five years. Foreign direct investment in the Chinese economy has fallen to a 30-year low. South Asian countries are now supporting the global economy: India, Vietnam, the Philippines, and Indonesia, and the countries of the Middle East – the UAE and Saudi Arabia.

Other types of investment assets remain underinvested

The real estate market, as a traditional investment asset, is going through one of the worst times in the world. Rising mortgage costs, higher funding costs, problems of developers in China and Germany, high vacancy rates in Europe and the US are just some of the challenges faced by the global real estate market. As a result, the cost per square meter in the US fell to the level of 2019, and in Europe – to the level of 2015-2016.

The cooling of investment activity is also observed in the M&A, venture capital and IPO markets. 2023 was one of the worst years for investment banking in the world.

Such an imbalance with the public market is extraordinary. We are likely to see a decline in demand in the securities market as well, with investment capital shifting to underfunded industries.

According to the 10-factor methodology, the current level of the S&P 500 index indicates a threat of overvaluation in six factors

This is given the fact that sectors such as real estate, energy, oil/gas, and FMCG are in a strong downward trend.

For 2024 and 2025, JP Morgan estimates that US companies’ revenues will grow by 11% and 13%, respectively. This is very optimistic, given the growth rate in 2022-2023 of 5% and 1%, respectively. As well as the downward trend in margins for the third year in a row.

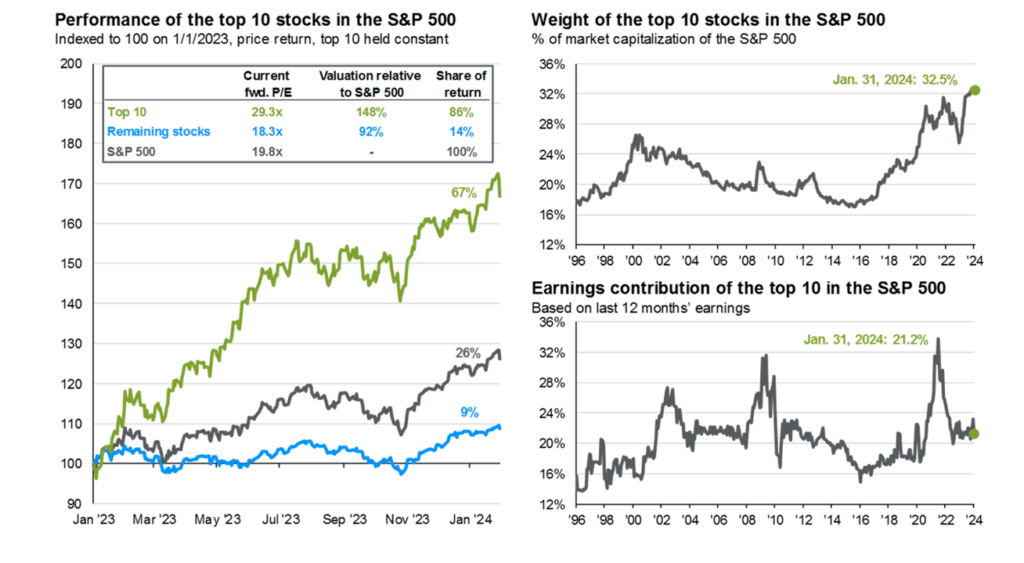

The top 10 companies in the S&P 500 index accounted for 67% of the growth of the entire US stock market. Their value multiplier reaches 30 times net profit. That is, under unchanged conditions, the top 10 American companies have 30 years to pay investors 100% of their net profit in the form of dividends so that shareholders double their investments.

The “Magic Seven” has an average valuation of 45x net income, 12x revenue, and 20x EBITDA. Such high multiples are appropriate in the venture capital market for companies, but too optimistic for trillion-dollar corporations with business growth of 13% per year.

So, as always, we have arguments for and against stock market growth. The market should reassess the current multiples, taking into account the above factors, geopolitics, and the real impact of new technologies and interest rates on the global economy.

Even during positive periods for stock indices, the depth of the market decline can reach 6-14% during the year. This will be a great opportunity for new investments in the capital market.

Source: Fordes.ua