Macroeconomic forecast. The Ukrainian economy is expected to follow the base case positive scenario in 2021-2022, while in 2023 there will be a period of rising risks for macroeconomic stability.

Base case forecast

The Ukrainian nominal GDP will reach $183 billion for the full year of 2021, while real GDP growth is expected at 4.3%. The main drivers of economic growth are presented below:

• Favorable pricing environment on the global commodity market, which led to an increase in the volume and value of exports for the country’s agricultural and metallurgy sectors. Higher commodity prices accelerated inflation with a positive effect on nominal GDP.

• Consumer spending recovery amid a stable situation in the domestic financial market.

• Effective actions of the National Bank and the Finance Ministry in refinancing debt in 2021–2022.

The baseline scenario envisages that the Ukrainian economy will grow to $205 billion in 2022, then to $213 billion in 2023, and $232 billion in 2024. The real GDP performance is expected to be volatile with a growth of 3.6% in 2022, a rise of 1.6% in 2023, and an increase of 2.6% in 2024. The lower GDP growth figure for 2023 is explained by several factors, including the start of the new political cycle in the country and possible imbalances in the external markets.

It is expected that 2023 will be a year of global economic turbulence, which will slow down the growth across the countries including Ukraine. However, this should not lead to serious structural problems for further development.

I would like to note that in 2021-2022, the Ukrainian economy will be performing in line with the positive scenario. Favorable global market conditions should ensure sustainable growth for Ukraine in 2022. The country’s economic growth will be also supported by an inflow of foreign direct investments, demand from non-residents for UAH-denominated domestic bonds, and adequate interest rates for refinancing on the external markets.

I also consider two alternative scenarios for the development of the Ukrainian economy. Below we highlight the key triggers.

Growth scenario

• The IMF support and signing of a new stand by program

• Solid demand from non-residents for government bonds and Ukrainian assets, an increase in foreign direct investment

• Growth in consumer and corporate lending

• Launching of the full-scale stock market in Ukraine, a boom in IPO and M&A, the attraction of large international investors in the country

• The government shake-up for more priority on structural reforms

• Large privatization

• Commodity super-cycle

• Maintaining the soft monetary policy in the US and Europe

• “Victory” over the coronavirus in the world.

Negative scenario

• Failure of talks with the IMF

• Debt problems in 2023-2024.

• Devaluation of the hryvnia to the level of 35 UAH/USD

• Referendum on NATO accession in 2023

• Military escalation in Donbas and further Russian aggression against Ukraine

• Weak government, change of power in the country

• Correction of prices for grain and industrial metals

• Premature tightening of the monetary policy in the US and EU

• Slowdown of the global economy, debt problems.

Coronavirus

The spread of the delta strain of coronavirus in Europe and the world will inevitably lead to a worsening of the epidemiological situation in Ukraine in September-November 2021. However, according to the baseline scenario, the government will not return to a practice of tough lockdowns, it will only apply targeted restrictions on the work of employees in offices, visiting restaurants, and shopping centers. This policy will have a minor negative impact on the growth rate of the economy this year. I will add that despite the slow vaccination process, the impact of possible lockdowns in subsequent years on the national economy, I estimate as minimal.

Cooperation with the IMF

The baseline scenario assumes the resumption of cooperation between Ukraine and the IMF while maintaining the current pace of legislative reform. The national budget deficit will be in the range of 2% – 4% of GDP, which will allow Ukraine to continue to build up the FX reserves (up to $34 billion in 2022) with a subsequent return to $32 billion due to large payments on external debts in the period of 2023-2024.

According to my forecasts, the National Bank policy will be moderately tough, keeping the key interest rate in the range of 8% – 9%, and the average annual exchange rate of the national currency will not exceed UAH 30 per dollar until 2024. An important assumption factor in the baseline scenario is no military escalation with the Russian Federation in the Donbas and Crimea. Meanwhile, the domestic political situation in Ukraine will carry limited risks. Although the ruling Servant of the People party has lost its absolute majority in Parliament, the appointment of a new government can be expected only after the parliamentary elections in 2023.

Ukrainian foreign currency reserves will be replenished by $2.7 billion in September as part of the additional issue of SDR by the IMF. The FX reserves will be also supported if the government manages to receive financial assistance from the IMF under an active stand-by program in the amount of $700 million by the end of 2021, as well as $500 million in 2022.

Renewed confidence in the IMF cooperation will open for Ukraine additional financing in an amount ranging from $1.2 billion to $3 billion from other international donors until the end of 2022. On the other hand, I doubt that Ukraine will be able to agree on the new program with the IMF for 2022-2025, taking into account the parliamentary elections in 2023 and presidential elections in 2024.

Ukraine’s foreign currency reserves will grow to $32 billion by the end of 2021, taking into account the expected financial receipts and payments on external liabilities. The country’s lower external debt repayment amount in 2022 and the high probability of refinancing of the foreign currency-denominated domestic bonds will allow the National Bank to increase its FX reserves to $34 billion next year. From 2023 through 2024, it is possible to predict a decrease in the National Bank’s FX reserves to $32 billion amid the hryvnia devaluation risks, an unpredictable situation with the foreign debt refinancing, and the expected increase in the interest rates on the international debt market.

Increase in the National Bank’s key policy rate

The key interest rate will likely remain in the range of 8.0% – 9.0% in the long term. This level of the key rate will be translated into acceptable yields on government bonds for both for the Finance Ministry and investors, in case inflation slowing down back to 5% – 7% in the next years. Non-residents are often considering speculative opportunities in the hryvnia denominated financial instruments. In general, monetary policy in Ukraine will be moderately tight and will restrain the banking sector from stepping up lending programs for the economy. Non-bank financial institutions will increase their presence in the Ukrainian credit market.

In our view, the following factors will contribute to the stability of the Ukrainian hryvnia in the second half of 2021:

1. Significant inflow of foreign currency is expected to Ukraine from agro exports, as well as steel and iron ore exports this autumn.

2. Ukraine covers the need for additional foreign currency financing, thanks to receiving the SDR allocation from the IMF and the next tranche from the IMF under the stand-by program.

3. The more or less balanced current account due to increased remittances from the Ukrainians working abroad is a positive factor for the hryvnia. The Finance Ministry should be able to cover the central budget deficit by placing additional government bonds.

Farmland market

On July 1, 2021, a 20-year ban on the sale of agricultural land was lifted. According to the law, until 2024, only residents of Ukraine can act as buyers, with the maximum ceiling of farmland in one hand should not exceed 100 hectares. Such tough restrictions will constrain activity in the land market. However, the norms of the law provide time for testing new conditions, settling legal nuances, and other “test” conditions for opening a land market in 2024 for large agricultural businesses within the country. Therefore, I predict a neutral effect on budget revenues from the secondary land market until 2024, while a positive effect from the farmland market launch can be estimated at +0.2% for the real GDP growth.

Risks

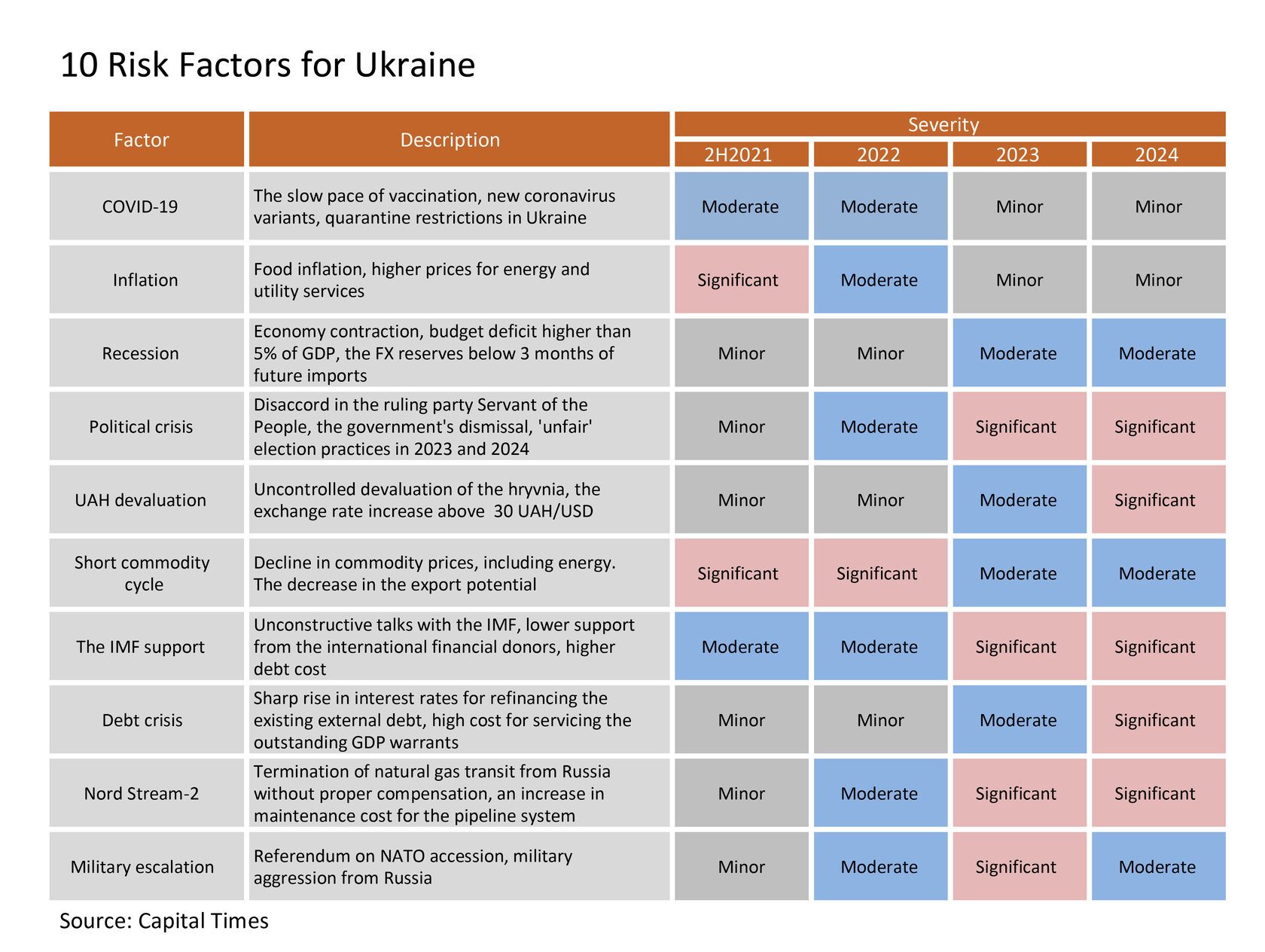

There are 10 risk factors for the Ukrainian economy. These are coronavirus, inflation, recession, political crisis, devaluation of the hryvnia, short commodity cycle, the IMF support, debt crisis, Nord Stream-2, and military escalation. The degree of influence of these factors is presented in the table below.

Exclusive article for NV Business