The war has caused a decline in activity in all markets, and M&A is no exception. However, despite the difficult conditions, some players still managed to acquire Ukrainian assets, and even some Ukrainian companies managed to become owners of new assets. What happened in the M&A market in 2022, what are the forecasts for this year, whether there is investment interest, and whether global companies are ready to consider projects from Ukraine, Sergiy Goncharevych, Co-Founder of the Children of Heroes Foundation and Managing Partner of Capital Times, told Mind.

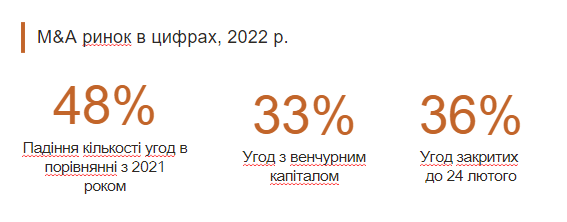

More than a third of the deals in 2022 (36%) were closed by February 24. Since 2021 was one of the record years in terms of the number and value of acquisitions, and although activity declined at the end of 2021, a certain number of deals were closed in 2022 due to the peculiarities of the M&A process (on average, the deal takes more than six months to complete).

Instead, several deals that started in late 2021 were canceled or suspended due to the full-scale war. In particular, in November 2021, the Polish shareholder Getin Holding signed an agreement with FUIB to sell Lviv-based JSC Idea Bank – but due to the geopolitical situation in Ukraine – the plan to sell the bank was canceled. The assets and liabilities of Ukrainian companies are no longer considered for sale.

Despite the decline, the Ukrainian IT market continued to be active in 2022

The market almost stopped, with only the TMT (telecommunications, media, technology) sector, including IT, continuing to live. TMT remained the most active sector in the Ukrainian M&A market in 2022, despite a 27% drop. 6 out of 10 deals involved venture capital.

A characteristic feature of 2022 was a higher number of investor exits from Ukrainian companies in this sector than in previous years. However, in the context of a full-scale war, this is the only sector that showed revenue growth and contribution increase to the country’s GDP. According to the IT Ukraine Association, in 2022, the IT industry provided foreign exchange earnings to the Ukrainian economy equal to $7.34 billion, as evidenced by the NBU data. Exports increased by $400 million (+5.8%) compared to pre-war 2021.

In general, Ukrainian IT companies will be in demand, and buyers will continue to look at the following indicators:

- business volume;

- EBITDA;

- client portfolio and its diversification;

- clients’ geography;

- technology stack;

- key team;

- processes, financial accounting.

But new indicators have also been added, such as the presence of owners and key personnel (at least 20%) abroad. Of course, foreign investors also look at risks: the risks of the team and the geographical location of the office in Ukraine.

Many Ukrainian companies have relocated their offices, most of them to neighboring Poland. Today, more and more companies are looking for diversification. Thus they are opening offices in Europe, as well as in Latin America and even India. For example, IT company Intellias closed a $20 million deal to acquire Digitally Inspired – a fast-growing UK-based IT company focused on the retail and e-commerce industries. So, the company announced a new development center opening in the Indian city of Pune and is planning to hire about a hundred IT specialists there. In addition, this year Intellias announced plans to enter the Colombian market.

There were no significant investments worth hundreds of millions in 2022. The most interesting, in our opinion, and one of the largest, we would call the Round C investment in the Ukrainian EdTech startup Preply from Owl Ventures, Diligent Capital Partners, Hoxton Ventures, Educapital, Evli Growth Partners, Swisscom Ventures, and Orbit Capital. The estimated value of the company after the investment is about $400 million, and the total investment in the company exceeds $100 million. In total, the number of deals in the Ukrainian TMT sector amounted to more than 50% (56 deals out of 106).

What is the situation with other markets?

As mentioned above, only 106 deals were closed in 2022. It is 48% less than in 2021 and the lowest figure since 2018. The total value of deals amounted to $300+ million, which is only 12% of the value of closed deals in the previous year. Keep in mind that this figure reflects only deals with disclosed value. However, it will double, at best, after including the estimated value of undisclosed deals.

The number of deals in the energy and natural resources sector fell more than threefold over the year. It is also worth noting that more than half of the deals in the sector for the year were closed before February 24. The number of deals in the renewable energy segment did not experience a sharp decline – three deals compared to five in 2021, although their total value was not significant.

Demand for energy assets will continue in 2023. Now we have inquiries from renewable energy companies – they are actively looking at assets abroad.

Unfortunately, there are currently no energy storage projects in Ukraine, but this is the future, and a lot of attention will be paid to this area over the next 3-5 years.

Unlike in previous years, there were no major landmark deals in the heavy industry sector: their total value did not exceed $50 million. Traditionally buyers were local companies from the sector.

This year, there may be a small number of deals involving the acquisition of smaller competitors by companies from the agriculture and logistics sectors. Companies from the western part of Ukraine will be in the highest demand. However, we should expect that the highest number of deals will be made up of acquisitions of European companies by big Ukrainian players.

Logistics and courier services will expand their geographical markets and follow the clients who have moved outside the country, such as Nova Poshta, which opened a branch in Poland in 2022 and plans to become a global international carrier.

Shortly, there will be demand for FMCG companies, but there will be a big difference in estimates. Large Ukrainian companies in this sector are looking at assets abroad themselves, and this trend will continue in 2023.

One of the landmark deals was that of Biosphere Corporation, which bought a plant in Romania and the well-known Austrian brand ALUFIX. Thus, the corporation became the owner of a portfolio of trademarks of a large European manufacturer of household goods, a plant in Romania, and sales offices in four EU countries. This deal best demonstrates the mood of Ukrainian business, which is actively looking for new opportunities in the European Union market.

M&A is a useful tool for entering international markets

We are currently working on several projects for the FMCG sector to diversify our presence, buy assets abroad, and enter international markets. And the easiest way to do this is with the help of M&A tools. Because it is:

- The prospect of getting a ready-made business with clients and staff.

- Favorable conditions for rapid growth.

- The ability to raise funds for European deals.

Today, there is some trend in requests for quick and “painless” entry into the European market. Currently, our company alone is working on 4-5 such projects.

The number of transactions and their distribution by sector generally do not raise questions. The only thing that may be surprising is the lack of restructuring projects in 2022 – either the banks have learned to work with this, or it is still to come.

As for 2023, we should expect the following:

- The TMT sector (in particular, IT) will remain the leader.

- The demand for purchases and the search for growth points abroad will continue in the following 2-3 years.

- The next two years will be the most difficult for the investment and M&A market. After 2014 and the outbreak of hostilities, it took two years for the volume and number of deals to grow.

- In the banking sector, we expect new cases of bank restructuring and recapitalization in 2023.

- There will be challenges for the agricultural and logistics sectors. There should be more deals in the sector. Remember that in 2024 we expect the land market to open for legal entities.

Essentially, the M&A market and demand for Ukrainian companies are affected by the difference in expectations between buyers and sellers during the war. It is currently the main reason why there are no deals on the market.